In an environment where unemployment remains at historic lows, many employers seek ways to keep their existing staff happy and to attract talented new workers. However, some businesses may be leery of taking on future financial obligations.

One tool in a business’s arsenal is the 419(e) plan. These plans offer benefits for both employers and employees — if they are set up and administered carefully.

What Is A 419(e) Plan?

A 419(e) plan is named for the corresponding section of the Internal Revenue Code. At its most essential, this plan provides a funded welfare benefit for employees. A single employer — plans pooled between employers are not permitted — can use a 419(e) plan to prepay welfare benefits covering a variety of scenarios. These may include illness, accidents, long-term care, disability or death (in the form of survivor benefits). Benefits from a 419(e) plan are not, however, retirement benefits or a pension.

In most cases, a 419(e) plan is structured as a trust. An independent trustee controls the trust’s assets, and a third-party administrator approves plan administration and arranges actuarial certification of the plan’s funding. The business makes irrevocable cash contributions to the 419(e) plan. These assets cannot revert to the employer, regardless of whether an employee participant leaves the firm. In turn, employees don’t vest, but rather gain access to the promised benefits when certain conditions are met (often upon reaching a set age).

In addition to employer contributions, the trust may also own life insurance. Term insurance typically funds death benefits only. Some plans may also use universal life insurance to fund post-retirement medical or disability benefits. The plan can also pay welfare benefits with loans against a policy’s cash value or with outright cash withdrawals when appropriate.

While business owners must be careful to structure a 419(e) plan in accordance with tax rules, they can customize the plan somewhat. Contributions on behalf of certain key employees may be kept separate from those made on behalf of other workers (though the plan must offer benefits at some level to all employees of the business). The sponsoring employer is permitted to choose either a target benefit or a target contribution amount; in either case, contributions are determined actuarially using employees’ projected retirement ages and predicted medical costs. Employers may also select which of the permitted welfare benefits the plan offers to employees. A plan that already offers survivors’ benefits to employees’ loved ones may later grow to also offer expanded welfare benefits to cover expenses related to disability, for example.

Benefits Of A 419(e) Plan

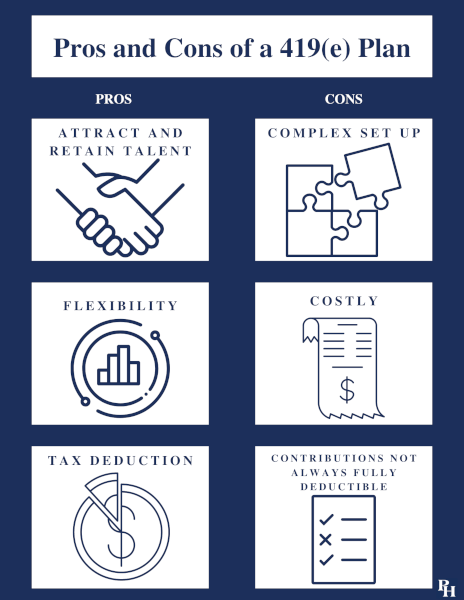

As with many sorts of benefits, the main purpose of a 419(e) plan is to attract and retain skilled employees. A 419(e) plan allows a company to offer a suite of benefits to employees, including business owners, and to fund these benefits in advance so that they do not represent future liabilities. Large contributions to the plan in the early years have time to grow under the trustee’s management. Relatively small operations with strong cash flow are often ideal candidates for 419(e) plans.

One of the most popular uses of a 419(e) plan is to cover post-retirement medical and long-term care benefits. Long-term care insurance, as my colleagues have written, is a flawed product that addresses a genuine problem. As the need for long-term care, and the price of such care, continues to grow, offering benefits to help fund these costs can be an attractive incentive for staff members.

Another attractive feature of 419(e) plans is their relative flexibility. A business may tailor an employee benefit plan to meet specific needs of its workforce, or to reflect the funding option that works best with the nature of the business itself. Some 419(e) plans offer benefits both before and during retirement, while others offer benefits only to retirees. Separating contributions for key employees can let businesses increase incentives to retain workers most central to the organization’s future success, though generally this can only apply to benefits paid prior to retirement.

In addition to the personnel benefits, a business sponsor may also obtain a substantial current-year tax deduction, within limits, for contributions to a 419(e) plan. Employers who plan to offer these plans and take the associated benefits would be wise to do so in consultation with an expert, as the particulars can become complex. For example, the Internal Revenue Service has issued guidance excluding some benefits for plans funded with permanent life insurance. The particulars are beyond the scope of this article, but business owners considering a 419(e) plan should factor in the costs of administration and tax compliance.

Since contributions to a 419(e) plan are irrevocable, trust assets are also sheltered from creditors. This can give both the business owner and employees peace of mind for the future.

Potential Downsides Of A 419(e) Plan

No strategy is right for every business, and 419(e) plans are no exception. As I noted in the previous section, these plans are relatively complex to set up and administer. Doing so correctly requires the service of an actuary who is experienced in 419(e) plans. A third-party administrator will need to set up a plan that adheres to IRS regulations in order for the business to take the associated deductions. For example, if a 419(e) plan offers post-retirement medical benefits, these must generally be available to all the company’s employees. This may be less of a concern for small, family-owned businesses with few or no outside employees. Exactly which welfare benefits the plan offers may also limit or dictate which sorts of life insurance the plan’s trust can hold.

It is not only the initial setup that will be complex and potentially expensive. Like any trust, ongoing administration for a 419(e) plan represents a serious cost. In addition, the third-party administrator must arrange actuarial certification of funding for the plan. Deductions must be actuarially certified, too. In the mid-2000s, the IRS turned special scrutiny on 419(e) plans, issuing audit notices frequently not only to sponsors but also to participants. As always it is important to substantiate tax positions. In the case of 419(e) plans, the ongoing involvement of a qualified third-party administrator is critical.

Contributions to the plan may not be fully deductible, even when the plan is properly structured. If the plan offers death benefits to employees’ beneficiaries, some portion of the business’s contributions may not be deductible, for instance. There are also restrictions on how the 419(e) plan may use life insurance to fund benefits, and failure to follow the rules could mean tax benefits are lost.

While 419(e) plans require resources to set up and administer properly, when they are a good fit, they offer business owners a flexible and attractive way to retain employees, especially key personnel.