A Section 529 plan is an excellent option to help save for your child’s education — or anyone else’s education, for that matter. However, not every 529 plan is the same, and choosing the right plan will help you to get the most out of your savings.

Before you decide on a particular 529 plan, you should first understand the types of plans available. Consider the pros and cons these types of plans generally offer, and then drill down into a particular plan’s specifics before you open an account.

What Are Section 529 Plans?

First, we will define our terms. A Section 529 plan is a state-sponsored tuition plan designed to help account owners save for a beneficiary’s future education costs. Beneficiaries are often account owners’ children, but they don’t have to be. These plans come in two formats: prepaid tuition plans and college savings plans.

Prepaid tuition Section 529 plans allow savers to pay for future tuition expenses (measured in years, credits or units) at present tuition rates, plus a small premium. They are somewhat restrictive, in that students usually must attend an in-state college or university to get the greatest benefit, and plans vary as to whether they cover private or out-of-state institutions at all. In addition, these plans build in the risk that the plan’s sponsor will be unable to fulfill their end of the deal and deliver on the promised benefits when the beneficiary is ready to attend college. For these reasons and others, we generally discourage clients from pursuing this type of Section 529 plan.

Section 529 savings plans are similar in that they are built to help participants save for educational expenses, but they are structured differently. They do not guarantee participants can pay today’s tuition rates. Instead, these plans act as tax-exempt savings vehicles. The owner makes contributions into a designated investment account where the funds grow tax-free. The account beneficiary can eventually use these funds for qualified educational expenses, including not only tuition, but also books, computers, and room and board. In contrast to most prepaid tuition plans, the account beneficiary is not limited to in-state schools. We will discuss additional pros and cons of 529 college savings plans in the following sections, but in general, we recommend these plans most often to clients seeking to save for higher education.

You may also have heard of 529A savings accounts, also known as “Achieving a Better Life Experience” accounts or ABLE accounts. Although ABLE accounts are similar to Section 529 college savings plans in some ways, they are not designed to fund educational expenses. Instead, ABLE accounts are tax-exempt investment accounts for individuals with disabilities. While they are a useful tool, they are not relevant to nondisabled individuals looking for an effective way to save for college.

Advantages Of Section 529 Plans

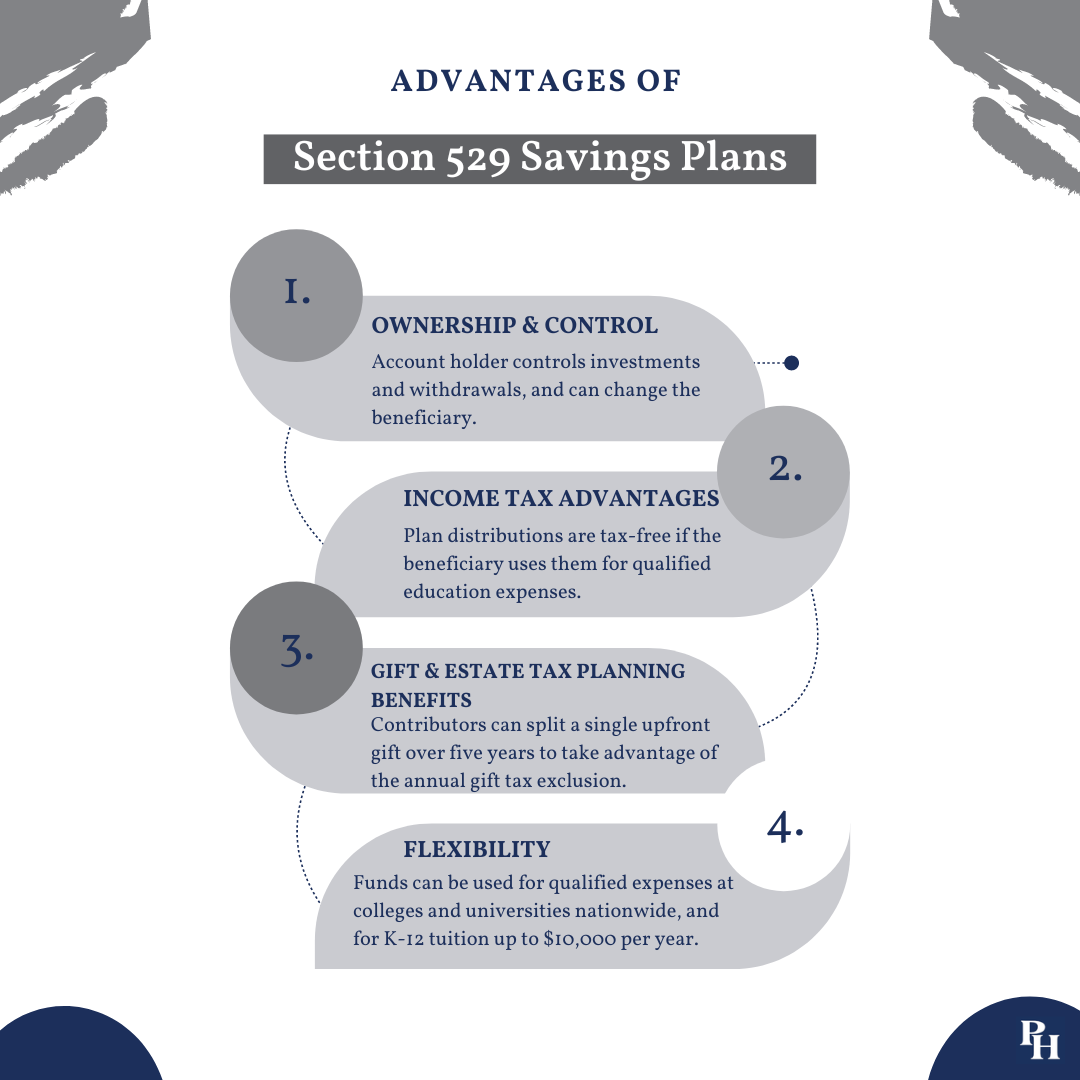

Certain benefits apply to all Section 529 college savings plans: ownership and control, income tax advantages, gift and estate tax planning benefits, and flexibility.

Ownership and Control. Section 529 savings plans are relatively easy to set up and offer account owners a high degree of control. 529 plans are unique compared to other education savings strategies, in that the beneficiary never gains control of the account. Only the account owner can authorize withdrawals or make changes to the investments in the account. Further, if circumstances change and the original beneficiary decides not to attend college, the account owner can change the account’s beneficiary. As long as the new beneficiary is a member of the original beneficiary’s family, this change will trigger no adverse tax consequences. Account owners may change the beneficiary as often as once every 12 months.

Income Tax Advantages. Contributions to any 529 savings plan grow tax-free as long as the funds are withdrawn to pay for qualified education expenses. Some Section 529 savings plans offer state income tax benefits as well: Many states offer an income tax deduction or credit for contributions to their state-sponsored 529 plan. Note, however, that some states offer greater benefits than others, or limit such benefits to residents only. It’s important to understand the details of a particular 529 plan when factoring in potential tax advantages.

Gift And Estate Tax Planning Benefits. The benefits of a 529 savings plan extend beyond income tax savings. As with other gifts, contributed assets up to the current year’s gift tax annual exclusion amount will not use any of the contributor’s lifetime gift and estate tax exemption. The 2024 gift tax annual exclusion is $18,000 per beneficiary, or $36,000 for a married couple. (For more about how the federal gift and estate tax works, listen to a recent podcast episode from our colleague David Walters.) This means that you can give up to $18,000 per beneficiary per year without having to file a gift tax return with the Internal Revenue Service. Additionally, it’s worth noting that gifts to a “skip person” — for example, from a grandparent to a grandchild, “skipping” the parent — also qualify for Generation Skipping Transfer tax annual exclusion (also $18,000 for 2024).

While the annual gift tax exclusion applies to any gift, Section 529 plans have a special feature that makes gifts even more powerful. Contributors to a Section 529 plan can superfund a single year by making a single lump-sum contribution and averaging that gift over five years. Since 529 accounts are most useful over longer time horizons, a big initial gift can let account holders get started without tapping into their lifetime gift tax exemption. It works this way: At this writing, a contributor can contribute $90,000 and elect to spread that gift evenly over the following five years ($18,000 per year). The giver should file a gift tax return to opt for this treatment, though no tax will be due. Because the average gift for each of the five years does not exceed the annual exclusion, the giver will not use up any part of his or her lifetime exemption. Married couples can double the gift amount up to $180,000 per beneficiary spread over five years. In this case, both spouses must file their own gift tax return to report the gift. It’s important to note that the annual exclusion and lifetime exemption amounts change annually. (For more on tax-effective gifts, see our colleague Paul Jacob’s article “Gift-Giving Makes Good Tax Sense, Except When It Doesn’t.”)

Flexibility. There are a lot of options when it comes to spending funds in a 529 savings account. The beneficiary will be able to use the funds at eligible educational institutions nationwide, including colleges, universities and vocational schools, regardless of location. Should the beneficiary decide to attend graduate school, they’re permitted to spend the funds there, too. As of 2017, qualified educational expenses for 529s can also cover public, private or religious K-12 tuition expenses up to $10,000 per year, per beneficiary.

Under the SECURE 2.0 Act, which became law in 2022, some beneficiaries may also roll over unused 529 funds, up to a lifetime limit of $35,000, into a Roth IRA. However, beneficiaries must meet certain conditions in order to be eligible for this option.

Disadvantages Of Section 529 Plans

While 529 college savings plans offer many benefits, they come with certain limitations as well. For most savers, these are not serious enough to offset the advantages, but you should be aware of them before opening an account.

Nonqualified Withdrawals. The tax-free growth 529 savings plans offer is appealing, but it doesn’t come without strings. Account earnings withdrawn from Section 529 savings plans for reasons other than to pay qualified education expenses are subject to both federal and state income tax, plus a 10% penalty. (Account owners can withdraw contributions without taxes or penalties, but every withdrawal must include a portion of earnings.) Should a circumstance arise where you’re considering making a nonqualified withdrawal from a 529 plan, we suggest exhausting most other options before incurring a penalty and tax consequences.

Limited Investment Options. The investment options in 529 savings plans are often limited compared to a taxable investment account. The menu of available investments varies by plan, so it’s important to consider the underlying investment options when evaluating 529 plans. The more diversified the underlying investment options, the better.

Impact On Financial Aid. Colleges will consider funds held in a Section 529 savings account owned by a potential student’s parents to be a parental asset when the school calculates the student’s eligibility for student aid. Parental assets do affect this calculation; however, they affect it much less than assets held in the student’s own name. (If someone else, such as a grandparent, owns the 529 savings account, the account balance will not affect the calculation at all.) Also bear in mind that a student must generally reapply for financial aid every year. A school — as well as the government, for those receiving federal student loans — may consider withdrawals from a 529 plan to be student income in the year they are distributed. This, too, can have a material effect on the student’s financial aid eligibility.

529 Plans We Recommend

Despite the drawbacks in the last section, a 529 savings plan remains one of the best tools available in saving for education. But there are many of these plans available. How should you choose? At Palisades Hudson, we often look at account fees and investment options when evaluating the most appropriate Section 529 savings plan for a client. We look for plans that offer a diverse mix of assets at a relatively low cost.

When you select any investment account, regardless of its purpose, you should pay close attention to fees, which can eat into your returns over time. Comparing a variety of 529 savings plans should help you to get a sense of what is reasonable. Management fees generally run from 0% to 0.99%. However, the way these fees are charged can vary. For instance, New York’s plan carries a single asset-based fee, while the Connecticut plan fee schedule varies depending on the portfolio approach and underlying investments that an account owner selects. Not every state plan includes an enrollment fee, but in general you should not expect to pay more than $50, and avoid even that much if you can. You should also avoid plans that charge annual maintenance fees, since many do not. Even if these fees are minimal — in the realm of $10 to $25 annually — they can add up. Some plans with these fees will waive them for account owners who set up automatic contributions. In addition to fees imposed by the plan itself, be sure to consider any fees associated with the underlying investments. All of these costs can seriously cut into asset growth in an account over time, so keeping them minimal is important.

The way to invest your 529 plan is beyond the scope of this article, but when you are selecting a plan, you want to ensure you will have access to a wide variety of investments so you can diversify properly. While there is no one-size-fits-all approach to investing a 529 plan, most offer two portfolio types: an age-based portfolio and a static portfolio.

An age-based portfolio’s asset allocation reflects the beneficiary’s age, relative to an assumption about when he or she is likely to need the assets. For many people, this is presumed to be around age 18, when a student going directly from high school to an undergraduate degree program would become a freshman. The particulars of an age-based portfolio will be specific to a given account holder and beneficiary, but we often recommend a 100% allocation to equities, or stocks, until the beneficiary is around age 12. Around this time, you will often want to begin reducing the portfolio’s risk as the beneficiary approaches college age. A typical approach would be to shift 10% of the portfolio toward fixed-income investments, or bonds, per year. This will typically slow the portfolio’s growth, but it will also reduce its risk as the student approaches the planned time to withdraw assets. For students who go directly from high school to college, this strategy results in a 100% allocation to conservative investments by their last year of a four-year degree. Some investors may want to make adjustments to be more or less conservative, but a glide path strategy will be appropriate in many cases.

A static portfolio's asset allocation remains constant over time. While the account owner can make manual adjustments if necessary, the goal of this portfolio is to keep the asset allocation consistent over the life of the account. As with any investment account, you should approach investing with a long-term plan and monitor your account carefully.

While fees and investment options are important considerations, the plan that is ultimately right for you will depend on your personal circumstances. Even so, a few options consistently lead the pack in our evaluations. At Palisades Hudson, we frequently recommend the following Section 529 college savings plans:

- Utah’s My 529 plan

- Connecticut’s Higher Education Trust

- Nevada’s Vanguard 529 College Savings Plan

- New York’s College Choice Tuition Savings Program (for New York residents)

These plans charge relatively low account administration fees and offer a wide range of investment options. You will also notice we included New York’s plan specifically for New Yorkers. The New York’s College Choice Tuition Savings Program provides residents with a state income tax deduction for contributions to the plan of up to $5,000, or $10,000 for married couples filing jointly. As we mentioned earlier, certain states offer a state income tax deduction or credit for contributions to a Section 529 plan, and this can tilt the balance in favor of your home state’s plan in some cases.

Once you’ve decided to save for education expenses, a 529 college savings plan can be a great tool to accelerate the growth of your savings. Whichever state’s plan you choose, get started as soon as you can. The longer you have, the better the opportunity for your contributions to grow and defray those rapidly rising college costs.