The U.S. Tax Court did not – quite – tell the Internal Revenue Service to beat it. But a recent decision represented a win for Michael Jackson’s estate and provided a case study in why hard-to-value assets can complicate estate planning.

Estate of Michael J. Jackson et al. v. Commissioner

Jackson’s death in 2009 marked the beginning of an extended dispute between the estate and the IRS. Upon review of the estate tax filing, the IRS issued a notice of deficiency. The Service billed Jackson’s estate for more than $500 million in taxes owed, and an additional $200 million in penalties.

The massive gap between the estate’s valuation of Jackson’s assets and the Service’s mainly arose from three particular assets. These were the value of Jackson’s name and likeness, and his interests in two trusts. One trust held Jackson’s 50% ownership stake in music publisher Sony/ATV. The other held his interest in publishing catalog Mijac Music, which included copyrights for many songs Jackson wrote or co-wrote. After an audit in 2013, the IRS valued these assets at around $482 million, collectively. The dispute between the Service and Jackson’s estate eventually narrowed to just the values of these three assets.

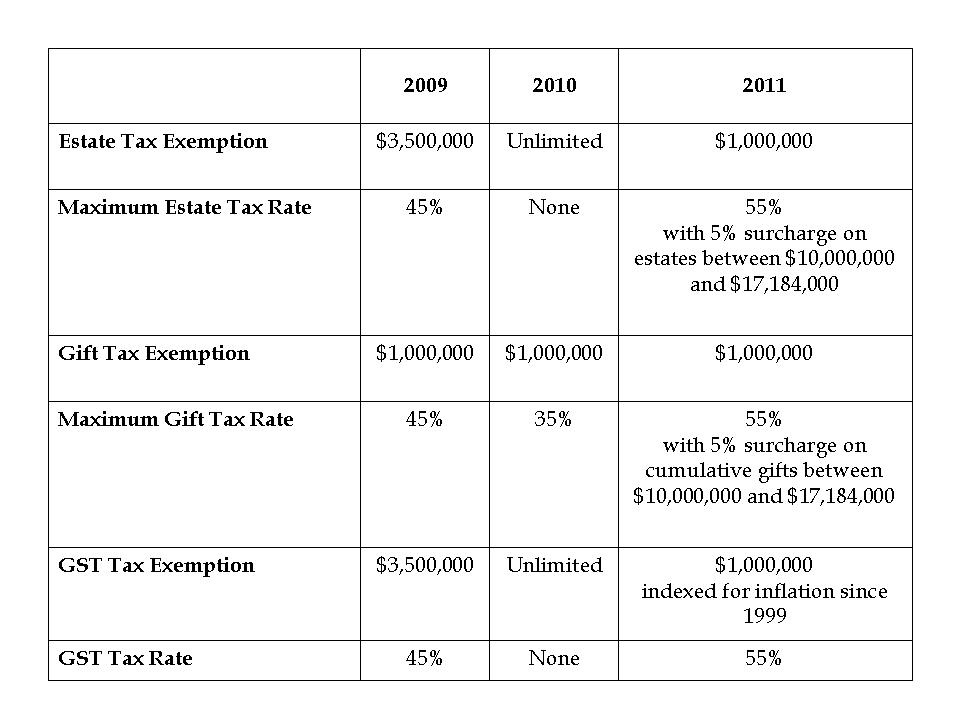

For estate tax purposes, assets are valued as of the date the individual in question died. The estate initially assigned a value of only $2,105 to Jackson’s name and likeness. Jackson’s executors argued that the pop star’s reputation was so damaged by legal troubles and erratic public behavior that his name and likeness were worth very little at the time of his death. However, the estate later acknowledged that the name and likeness rights could have been worth as much as $3 million – still a far cry from the IRS’s initial claim of $434 million, or even its subsequent claim of $161 million. With the figures $158 million apart from each other, an outright victory for the IRS would have meant a deficiency of more than $71 million, based on the top federal estate tax rate of 45% in 2009.

As for the two trust interests, the estate initially valued them at $0 (due to outstanding debts) and a little over $2 million, respectively. By the time the parties made it to court, the executors had raised that figure to $5.3 million for both interests. The IRS, in contrast, valued the interests at a combined total of about $320 million.

It is worth remembering that, while the King of Pop has had something of a resurgence in the past decade, much of that renewed popularity arose after Jackson’s death. Although Jackson was never found guilty of the allegations he faced, they hurt his ability to earn sponsorship and merchandising deals in the final years of his life. By the time he died, Jackson had taken on significant debt. Still, even allowing for the reputational damage Jackson suffered, his overall estate was well over the $3.5 million threshold for federal estate tax in 2009.

After years of legal wrangling between the estate and the IRS, the end is now in sight. In a win for the estate, Judge Mark Holmes of the Tax Court ruled in early May that the three assets in question were worth $111 million, far closer to the estate’s estimate than that of the IRS.

Valuing many illiquid assets has always been a matter of informed opinion. Unlike a stock, there is no way to prove beyond a doubt what, for instance, a celebrity’s name and likeness were worth on a particular date. Thus in a valuation dispute, each side provides expert testimony. These experts contribute to the court’s understanding of the disputed property’s true value. Jackson’s estate retained four experts: two to discuss Jackson’s name and likeness, and one each for the trust interests. In contrast, the IRS relied on a single expert for all three assets. Holmes made it clear in the ruling that this was a mistake. The court found that the IRS’s expert had lied during the trial, which led the judge to significantly discount his testimony.

However, rejecting IRS arguments did not mean accepting the executors’ positions outright. For instance, Holmes ruled that Jackson’s name and likeness were worth $4.2 million at his death. This was slightly more than the $3 million that the estate claimed by the time the trial began, and significantly more than the asset’s valuation on the original estate tax return. As Holmes observed, the estate originally was “valuing the image and likeness of one of the best known celebrities in the world — the King of Pop — at the price of a heavily used 20-year-old Honda Civic.” Even given Jackson’s reputational struggles in 2009, this valuation would not hold in the court’s eyes. When he died, Jackson was selling out dates for a planned world tour, though he could not secure a sponsor or merchandise partner for it.

Holmes also determined that Jackson’s share of Mijac Music was worth about $107 million at the time of his death. As with the name and likeness decision, the judge’s ultimate valuation landed between the two numbers presented by the parties, but closer to the estate’s assigned value than the IRS expert’s. Holmes also agreed with the estate that the trust’s stake in Sony/ATV Music Publishing was worth nothing at Jackson’s death, due to the trust’s outstanding liabilities. Like the name and likeness rights, this trust represents a case where executors have recaptured significant value. Sony/ATV, now rebranded as Sony Music Publishing, agreed to pay the Jackson estate $750 million in 2016 to buy out the estate’s share of the catalog, according to The New York Times. Yet the estate’s tax is based on what assets were worth in 2009, not how well they performed later. Holmes found that the estate’s success in managing these assets was not foreseeable more than a decade ago. In addition to determining the valuation of the three assets in dispute, the ruling denied the government’s request to collect penalties from the estate.

Estate Planning Lessons

It is worth noting that, under current law, few people need to worry about the federal estate tax at all. The unified credit currently covers $11.7 million, a significant increase from the $3.5 million cutoff that was in place in 2009. Tax law, however, is not permanent. Even individuals who would not owe tax if they died today can benefit from considering the effects of potential future changes. Individuals who expect their estates to owe tax, and especially individuals who own hard-to-value assets, can take away useful lessons from the Jackson case.

Valuing most assets is relatively straightforward. Some items, like cash and publicly traded stocks and bonds, do not leave much room for ambiguity. In contrast, certain unique assets are notoriously hard to value. The value of an individual’s name and likeness, for example, is difficult to pin down, even if everyone involved can agree they hold some value. Few people are Michael Jackson – or Prince, or Aretha Franklin, to name other recent examples of entertainers who left messy estates behind. But the rise of social media, YouTube and other DIY entertainment channels means that there is a larger gray area between mega-famous and quasi-famous individuals than there used to be. This could lead to more estates needing to consider the problem of valuing a decedent’s intangible assets after his or her death. Taxpayers and the IRS often disagree over the proper value of such assets.

As in many tax cases, domicile also comes into play. (If you are not familiar with the concept of domicile, see this blog post from my colleague Paul Jacobs: “You Say Goodbye, States Say Hello.”) The IRS argued that valuation of Jackson’s name and likeness should take into account rights the estate had under any state’s (or country’s) law. Holmes ruled that valuation need only consider rights under the law in the state where the decedent was domiciled. Jackson was domiciled in California, a state that provides significant rights. However, in another case of a decedent with nationwide or global appeal and with a different domicile, this precedent could come into play more significantly.

The Jackson case also illustrated how much speculation is necessarily involved in valuing assets like an individual’s reputation. It seems obvious that the name and likeness of a celebrity of Jackson’s caliber would have some value, even if the exact value was disputed. But at lower tiers of fame, the calculation becomes more complex. Say a famous chef started a restaurant, and a great deal of the value derived from his reputation. If his daughter continued to use her father’s name or likeness to promote the restaurant after his death, it would be difficult to determine the extent to which the restaurant might have thrived anyway due to her management skill.

This case illustrates, too, the importance of having reliable experts, preferably more than one, to support an estate’s valuation argument. Valuation disputes do not only hinge on name and likeness rights. Other notoriously hard-to-value assets include works of art, interests in privately held businesses, and unique intellectual property with no ready analogues for comparison (such as a patent for a novel technology). It is possible that the IRS will learn its lesson after demonstrably overreaching in the Jackson case. Taxpayers, though, should still be prepared to produce evidence for the valuations included on a gift or estate tax return.

Many observers of the Jackson case expected the Tax Court to land on a figure between those provided by the IRS and those provided by the estate. This is exactly what happened. But the court’s figures were closer to those the executors cited, serving as a rebuke to IRS overreach. Even so, taxpayers who own assets without clear-cut values should take the case as a reminder that those assets could become a battleground with the tax authorities.