To those of us who came of age between the eras of Vietnam and David Stockman, economic doom has always lurked just around the corner. LBJ’s guns-and-butter inflation, Nixon’s price controls, Ford’s WIN buttons, Carter’s sky-high interest rates and Reagan’s soaring deficits blend together, a seamless memory of bad news.

As the saying went, “Been down so long, it looks like up to me.” Despite some best-selling books predicting its imminent arrival, however, Armageddon never came. Today we bathe in a sea of good news, with unemployment near 25-year lows, inflation virtually absent, ebullient stock markets and growth that alternates between good and frighteningly good.

Is the picture really as rosy as it seems, or are we showing the same lack of perspective as a decade or two ago, only in the opposite direction? What risks should we keep in mind, and what should we do about them?

I like to focus on fundamentals. Every day, billions of people around the globe get up, do their jobs and go to bed leaving the world with just a little more than it had that morning. Except when interrupted by natural or man-made disasters, this process of wealth creation goes on day after day, year after year. So the normal state of economic affairs is that things get better over time. Not for everyone, not equally, not at the same rate in different places or different years, but continually.

Good news, then, should be the rule rather than the exception. The current spate of good news, coming after a long and painful restructuring of the economy that reduced regulation, increased competition and emphasized efficiency and quality, ought not to frighten us.

On the other hand, our hope — and the stock market’s evident expectation — that the good news will continue rests on some vital assumptions that are seldom discussed and poorly understood. If these assumptions are wrong, our future is going to be very different from what we expect. These assumptions include:

The Cold War Is Over; The Era of Global Free Trade Has Begun.

The U.S. budget is swinging into balance in part because of the “peace dividend,” the belief that we can safely downsize our forces now that the threat of Soviet aggression is gone. I believe that the Soviet threat is gone. Despite the turmoil in Russia, I think it is very unlikely that the Iron Curtain will rise again in Europe.

However, to the east, a new threat is rising in China. On its current course, China will become the first major country to go from communism to fascism. Fascist is the only word I know to describe a totalitarian society in which private business is allowed to profit, but only subject to the whims of a self-perpetuating political elite that compromises the judiciary and imposes its will on a disenfranchised population.

The Chinese approach is no accident. That country’s leadership apparently believes that slumping living standards and lack of political will brought down the Soviets and their eastern European satellites. Top priority, then, is to raise living standards and head off mass discontent. A concomitant is to brook no dissent that could become the nucleus of a challenge.

The Soviets had a hermetically sealed economy that could not attract capital with which to raise living standards. The Chinese, in contrast, welcome outside capital — on their own terms. Those terms include diverting a generous slice to the Red Army and, often, the transfer of key technologies. The result is a dual threat. First, by encouraging vast outside investment, the Chinese can eventually threaten to impose great losses and even insolvency on important foreign banks and corporations by nationalizing or otherwise impairing those investments. At the same time, the Red Army’s share of the profits from new ventures helps China bolster its military threat to its neighbors, particularly Taiwan.

If China succeeds in becoming the regional or global superpower it wishes to be, Taiwan will be retaken by force or coercion. Americans are no more likely to intervene than we were when the Soviets crushed the Prague spring in 1968. We may care about the people on Taiwan, but we will not go to war for them.

Beyond retaking Taiwan, Chinese policy will likely seek the Finlandization of Japan and Korea, assuming an eventual merger of the failing North into South Korea. With huge investments in China and a substantial military threat in their back yard, those nations will be much less likely to side with the West in disputes involving the Asian giant.

This dire scenario of renewed Cold War does not have to play out, of course. One can always hope that the Chinese democracy movement will flower again, and that the integration of Hong Kong thinking into mainland experience will make that country a truly reliable global partner. Who does not want to see a democratic China, governed by laws that are applied by an independent judiciary, take its place among the world’s great economic powers? For now, the risk is that we are all counting on this rosy outcome, and that we are unprepared economically or militarily for the greater threats that seem at least equally plausible.

The U.S. continues to adapt to rapid change.

There was great hand-wringing 15 years ago about the “hollowing out” of American industry, the death of manufacturing and the poor quality of our goods and services. Today the situation is reversed. Manufacturers in even basic industries have learned to prosper with new techniques and less labor. The quality gap in consumer durables has narrowed and blurred as U.S. companies improved their product while foreign firms opened up factories in the States. At the economy’s cutting edge, in microprocessors, “big iron” computers, software, financial services and aerospace, American companies either lead the competition or have no competition.

The ability to adapt has been a U.S. strength for so long that we take it for granted. This worries me. Every great power before ours has eventually succumbed to internal ossification and changing external conditions, and there are plenty of signs that this could happen here.

Two generations ago people considered change, which they called “progress,” inevitable. Today’s dominant attitude is NIMBY (not in my backyard). Local businesses tap this sentiment to resist potent competitors like Wal-Mart and Home Depot. Little-used subway stations remain open in neighborhoods whose populations and factories are long gone. Congressmen fight to keep military bases that serve no purpose other than to employ constituents. We all pay a price every time productive change is unreasonably halted to protect the interest of a small minority in the status quo.

There will be a lot of hype in New York City next year to commemorate the 1898 consolidation that brought the great city of Brooklyn, along with large rural swaths of the Bronx, Queens and Staten Island, into the metropolis. Consolidation set the stage for New York’s rise as the pre-eminent urban center of the 20th Century. Frankly, the 1898 consolidation could never have happened in today’s environment. We in the suburbs argue endlessly over such trivia as combining police departments and high school sports teams. One large city absorb another? Inconceivable!

If we permit our political and economic arteries to harden, we will sacrifice one of the key elements that made us what we are.

Our natural resource worries are over.

Adjusted for inflation, oil prices are back to the levels of the 1960s “muscle car” era. The muscle cars are back, too, in the form of those ubiquitous sport utility vehicles and minivans. Incentives to economize on all sorts of natural resources are diminishing throughout the economy, as the real cost of those resources declines.

Meanwhile, living standards are rising rapidly in many parts of the world. New televisions in China, new cars in Poland, new air conditioners in Malaysia, all point toward greater global competition for scarce resources. Oil once again emerges as the most likely choke point, especially because the big deposits in the North Sea and Alaska that helped break the market’s dependence on Middle East supplies are beginning to play out.

Could another political crisis generate a new oil shock? I see no reason why not, especially given the autocratic and brittle, if not overtly hostile, governments in key producing nations. Even without a big confrontation, simple laws of supply and demand should mean renewed upward pressure on many commodities in the years ahead.

It’s okay to burn out the baby boomers.

In Franklin Roosevelt’s time a typical worker might get eight or ten years of schooling before entering the labor force well before age 20. It was reasonable to expect these people to work for 45 or 50 years, then retire on Social Security for a few years before they died.

In our world even an entry-level worker needs 12 years of school, while managers and professionals may need up to 20. Then we want all of these people to be life-long learners, continuing their studies through their working years to keep up to date. Next, we add much higher spending on medical care so we can stretch their life expectancies into their 80s and beyond. The retirement age? It’s gradually being pushed by two years, to 67. Big whoop.

Rather than being realistic about retirement age, we compensate by having people work longer hours under higher pressure, trying frantically to compress enough economic output into a shorter working career to justify all this investment. Of course we don’t individually put it in these terms, but this is the societal bottom line. We say to the baby boomers, “We won’t work you longer; we’ll just work you harder.”

Does this make sense? What happens when these Boomers actually start retiring during the next two decades? One likely result is a big fat labor shortage, especially at the most skilled levels of the economy. Maybe it is time to rethink the trend toward portable pensions (read 401(k) plans) and early retirement, and start expecting our businesses to be planning for their human resource needs a decade or two from now.

For all these worrisome possibilities, I agree that the U.S. and global economy is in the best shape we have seen in at least three decades. With a fair amount of luck it may stay that way for a long time to come. Still, prudence requires that we remember those basics:

- Stock and bond markets can move a long way in a short time. Don’t get over- exposed to either equity or interest rate risks.

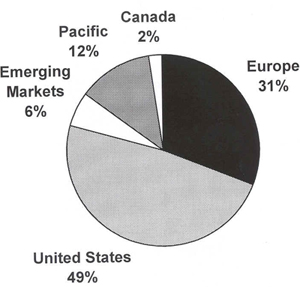

- International diversification is great, but some parts of the world are much riskier than others. Know where your money is.

- Good times never last forever. The best financial planning most people can do is to keep their lifestyles comfortably within their long-term earning power. Salt away some of the extra cash that comes in during the boom times. Remember the Biblical story about seven fat years being followed by seven years of famine? The business cycle has been around since those days, and it is not going to go away no matter who runs the Federal Reserve.